3 Life Insurers Whose Ratings Should Give You Pause

|

Back on Aug. 30, we shared our list of top-ranked life insurance companies — the ones that earned our highest Weiss Ratings. The goal? To point you toward strong insurers you can be confident doing business with.

Today, we're going to do the opposite. We're going to share the LOWEST-rated life insurance companies in our coverage universe. Using our powerful, proprietary screener technology, we zeroed in on companies that met the following criteria:

• The company received no better than a "D" Weiss Rating, but no worse than an "E-."

• The company must be licensed in all, or almost all, 50 states.

Three firms ended up in this "bottom of the barrel" sort. Our Ratings suggest you should pause and take a deep breath before using these providers for your life insurance needs, especially when there are many other higher-rated companies to choose from.

Here's a hint. One of these three companies shares the name of an airport and a Major League Baseball team. But it's doing the opposite of hitting it out of the park, where your family's future is concerned …

So who's at the bottom of the ninth with two outs?

|

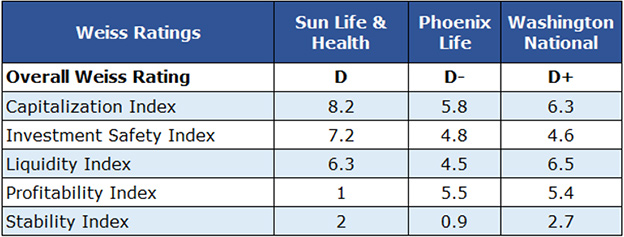

1. Sun Life & Health Insurance Co. (Rated "D"). This company has received a "D" or lower from Weiss Ratings for four quarters now. Its recent low grade stems from "Weak" levels of profitability and stability. Our analysis found that the weak stability was due in large part to negative cash flows and financial problems/weakness at a parent or affiliate company.

To further elaborate, Sun Life's biggest affiliates are Sun Life ASR Co of Canada, Independence Life & Annuity Co, and Professional INS Co. All three of them received Weiss Ratings of "D." This company has it all when it comes to red flags, including weak affiliates, weak profitability, and signs of instability, making it a candidate for this list.

2. Phoenix Life Insurance Company (Rated "D-"). This company has received a Weiss Rating of "D" or lower for well over two years now. In fact, it received a very low stability score of 0.9 out of 10. This weakness is primarily attributed to past weak results on the Weiss Ratings Risk Adjusted Capital test, negative cash flows, and past results in Weiss Ratings' investment safety index and liquidity test.

Moreover, four of their five largest affiliates are rated "D." These companies include PHL Variable, Constitution Life, Pyramid Life and Phoenix Life & Annuity Co.

3. Washington National Insurance Co. (Rated "D+"). Washington National is an airport, one that's located not far from where the Washington Nationals are playing the Philadelphia Phillies tonight. But that's where the positive connections to this insurer's name end.

This last company on our list is the only one that is not licensed in every state. (New York is the exception.) Washington National has been rated a "D+" or lower by our firm since 2013. That earns it the dubious distinction of having the longest streak of such low ratings.

The primary reason for the poor grade is Washington National's stability rating. The company has a past record of investment safety concerns, along with current parent and affiliate company weakness. It is highly exposed to "BBB"-rated bonds, and junk bonds are equal to 53% of capital.

Among their parent and affiliate companies are Bankers Life & Casualty, Colonial Penn Life and Bankers Conseco Life. All of those have received "D+" or lower grades from Weiss Ratings. Based on this information, we believe they are deserving to be on this list.

Of course, just because an insurer receives a low rating, that doesn't mean the firm is guaranteed to fail. But why take even one iota of additional risk when there are many more highly rated companies to choose from? To find them, consider using our Screener technology to work. Click here to start your search.

Best,

Gavin Magor

Director, Weiss Ratings

Weiss Ratings LLC financial analyst Shane Moore contributed to this report.