|

| By Sam Blumenfeld |

Bitcoin (BTC, Tech/Adoption Grade "A-") and other cryptocurrencies are trading higher today as most assets look for a relief rally. The broader crypto market is still looking significantly oversold, but investors must grapple with an unfavorable macroeconomic environment with four-decade-high inflation.

BTC is back above the critical $20,000 level. It'll need to hold above here for the market to continue building momentum, and it'll need to break above $24,000 to confirm June 18 as the cycle low.

Bitcoin has mostly traded between $19,000 and $22,000 since the middle of June.

It closed right in the middle of that range and above the $20,500 moving average yesterday but faced significant resistance when testing $22,000.

Ideally, we'd like to see Bitcoin establish $20,000 as solid support until it can break past resistance. That would keep the market leader nicely above its previous bull market peak.

Here's Bitcoin's price in U.S. dollars via Coinbase Global (COIN):

Ethereum (ETH, Tech/Adoption Grade "A") is trading 3% higher so far today, and it's jumped past $1,200 again.

ETH has followed the broader market's performance over the past month by trading in an established range between $1,000 and $1,300. The asset is almost exactly even for the week and month, but it has plenty of ground to make up considering it's down 60% over the past three months.

That's why it's promising that the No. 2 crypto established $1,000 as a strong support three separate times. It's the first step in ETH breaking its trend of lower highs and lows. To fully break the trend, ETH must overtake $1,300 without retracing below $900.

Like Bitcoin, Ethereum closed above its 21-day moving average yesterday, which sits at $1,150. If the asset can clear resistance at $1,300, ETH could challenge its previous bull market peak of $1,400.

As Ethereum trades sideways, investors are eagerly watching for developments surrounding its shift to proof-of-stake consensus, which my colleague Beth Canova wrote more about earlier this week.

The full merge could happen as soon as September, and it could act as a positive catalyst.

Here's Ethereum's price in U.S. dollars via Coinbase:

Index Roundup

The broader crypto market finished the seven-day trading week virtually unchanged, with some recording small gains and others minimal losses.

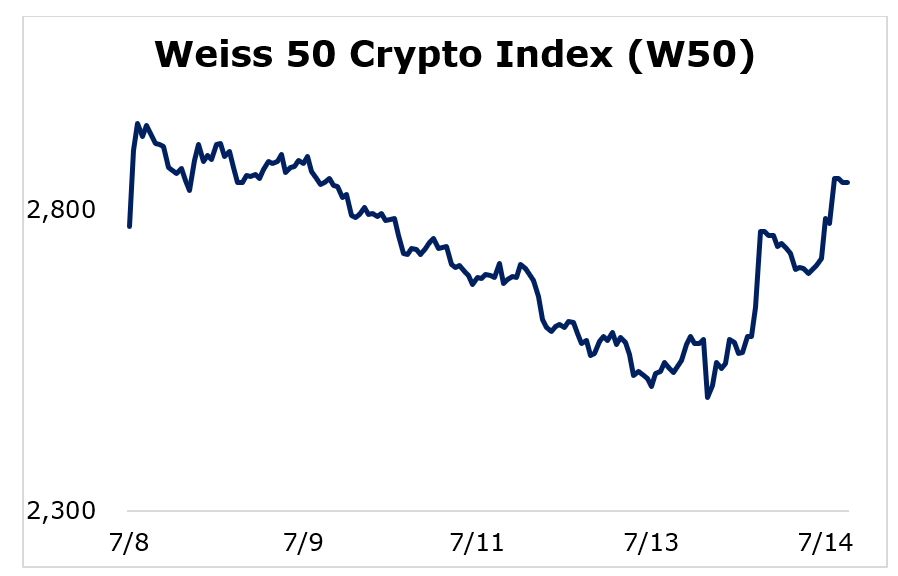

The Weiss 50 Crypto Index (W50) gained 2.61%, as the crypto market moved slightly higher overall.

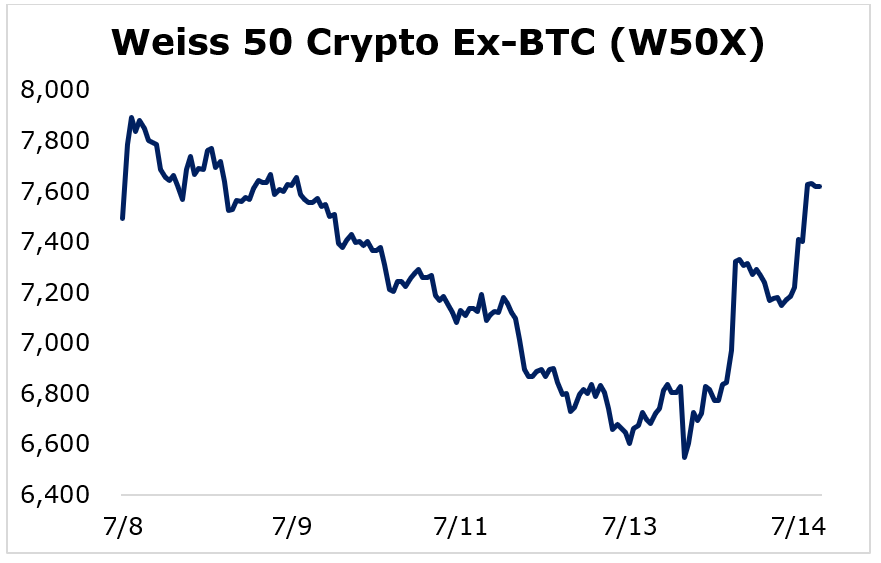

The Weiss 50 Crypto Ex-BTC Index (W50X) increased 1.67%, as Bitcoin marginally underperformed altcoins.

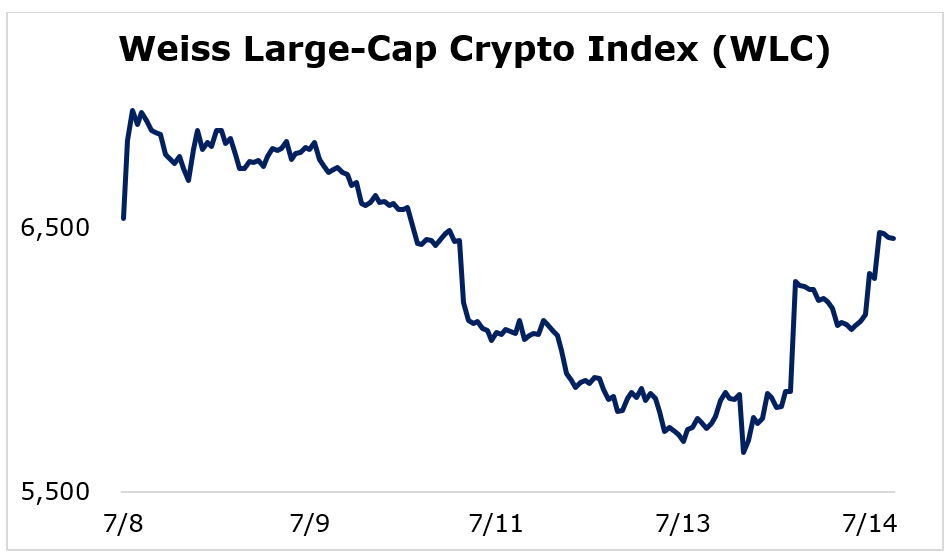

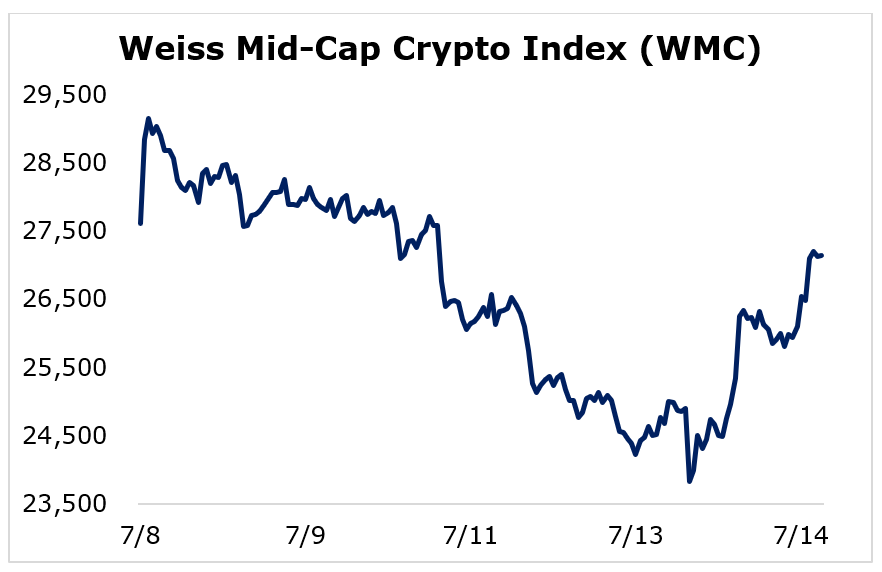

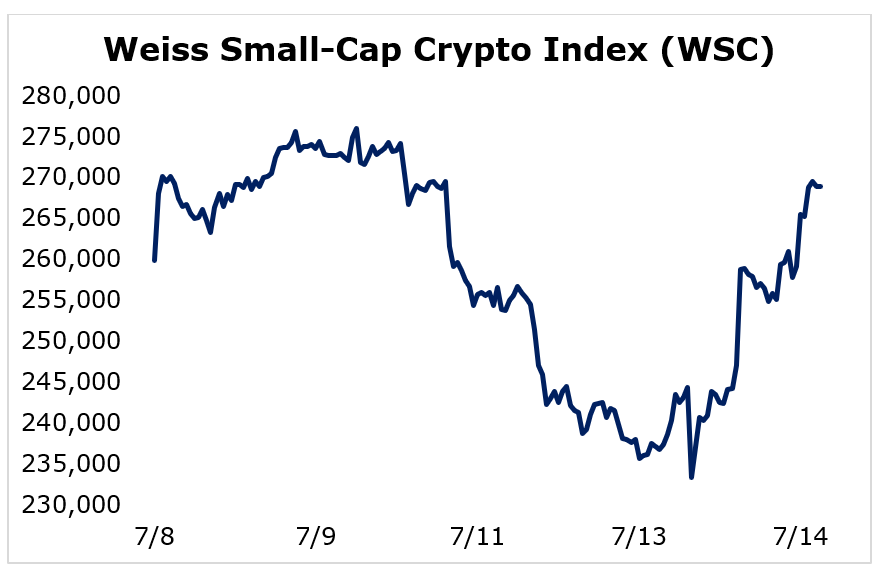

Breaking down performance this week by market capitalization, the small-caps were the only group to finish in the green. Larger and mid-sized cryptocurrencies couldn't quite manage to reverse their early week slumps.

The large-caps finished in the middle of the road, with the Weiss Large-Cap Crypto Index (WLC) sliding a minor 1.15%.

The mid-caps were the biggest underperformers, but the 1.70% drop in the Weiss Mid-Cap Crypto Index (WMC) is negligible considering the volatility of the space.

Small-cap cryptocurrencies were the top performers, as the Weiss Small-Cap Crypto Index (WSC) rose 3.47%.

The crypto market had a rough start to the week as investors digested 40-year high inflation, but assets rallied toward the end and brought many cryptocurrencies back toward monthly highs. For a bigger jump, Bitcoin and the large-caps need to break through overhead resistance.

Notable News, Notes and Tweets

- Michael Saylor points to future regulatory changes in crypto accounting policy.

- Centralized payment processors are paving the way for greater crypto adoption.

- On-chain metrics show that Bitcoin whales are still in hibernation while the asset continues trading sideways.

What's Next

Investors breathed a collective sigh of relief to see the broad market promptly rebound following the pullback caused by worse-than-expected inflation.

Still, the industry continues facing significant macroeconomic headwinds caused by the Federal Reserve's tightening, not to mention the war in Ukraine.

For cryptos to move higher in the long term, those headwinds will need to let up. In the near term, analysts are looking for any catalysts that'll give assets a push to break through the additional downward pressure.

The broad market benefits from the fact that it remains critically oversold, as that's keeping assets within their current ranges. But without that catalyst, assets will likely struggle to rally.

For now, your game plan should be to be patient. And to use this sideways market to research long-term opportunities that have the potential to soar when the macroeconomic outlook changes.

For solid projects that'll survive this crypto winter, current prices could be excellent discounts.

Best,

Sam