Crypto Looks to Stabilize After Tumultuous Trading

|

| By Sam Blumenfeld |

In the wake of the FTX meltdown, Bitcoin (BTC, Tech/Adoption Grade "A-") and other cryptocurrencies are trying to stabilize.

While the full extent of the damage is still unknown, the bad news prompted a wave of selling below the lower bound of Bitcoin's sideways trading range, establishing a new bear market low for BTC.

The asset fell below support at $17,500, so it will need to hold itself above $15,500 to avoid further downside weakness.

Bitcoin is about even today as it hovers around $16,700. It's trying to reestablish momentum following the sell-off, but a lot will depend on the exposure of other crypto institutions.

Bitcoin currently sits significantly below its 21-day moving average of $18,700. But the main concern right now is maintaining a NEUTRAL trading direction from here on out.

Here's Bitcoin's price in U.S. dollars via Coinbase (COIN):

Meanwhile, Ethereum (ETH, Tech/Adoption Grade "B") continues to hold up better than the market leader. ETH is up about a percentage point today and still trades above $1,200.

The second-largest cryptocurrency by market cap has plenty of room to go before it would retest its current bear market low of $880.

Ethereum's chart looks more stable than Bitcoin's since the Merge-induced sell-off. ETH mostly traded between $1,250 and $1,400 during its period of sideways trading, and it's not far from the lower bound even after the sharp recent pullback.

Notably, Ethereum was nearly able to reverse the Nov. 9 drop the following day. It continues consolidating, but it would be a positive sign if it holds above its recent closing low of $1,100.

If Ethereum continues trading resiliently, it bodes well for other altcoins that follow its direction.

Here's Ethereum's price in U.S. dollars via Coinbase:

Index Roundup

The broader crypto market finished lower this week, as it digested breaking news surrounding the FTX collapse and other companies suffering from contagion effects. Performance was mostly consistent across the board.

The Weiss 50 Crypto Index (W50) dipped 9.27% as the broader market edged lower.

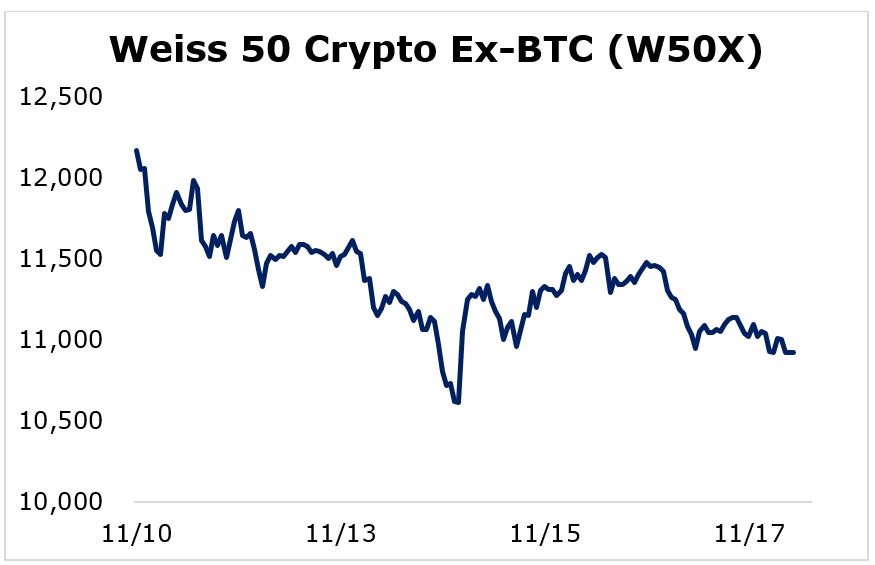

The Weiss 50 Ex-BTC Index (W50X) lost 10.26%, showing that Bitcoin narrowly managed to outperform other altcoins.

Breaking down this week's performance by market capitalization, we see most cryptos traded in tandem. Each market cap cohort ended the week lower, but performance was consistent within a couple of percentage points.

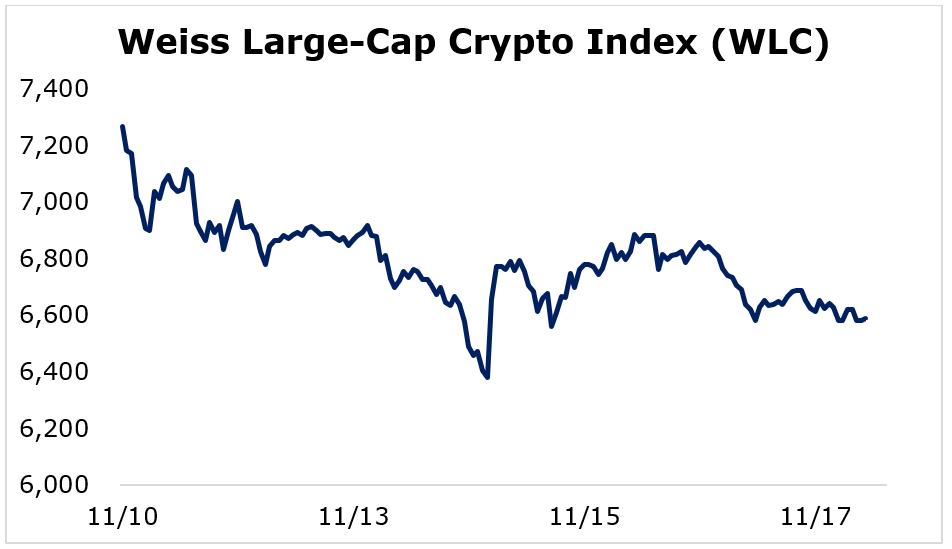

Large-cap cryptocurrencies finished in the middle of the road, as the Weiss Large-Cap Crypto Index (WLC) slid 9.34%.

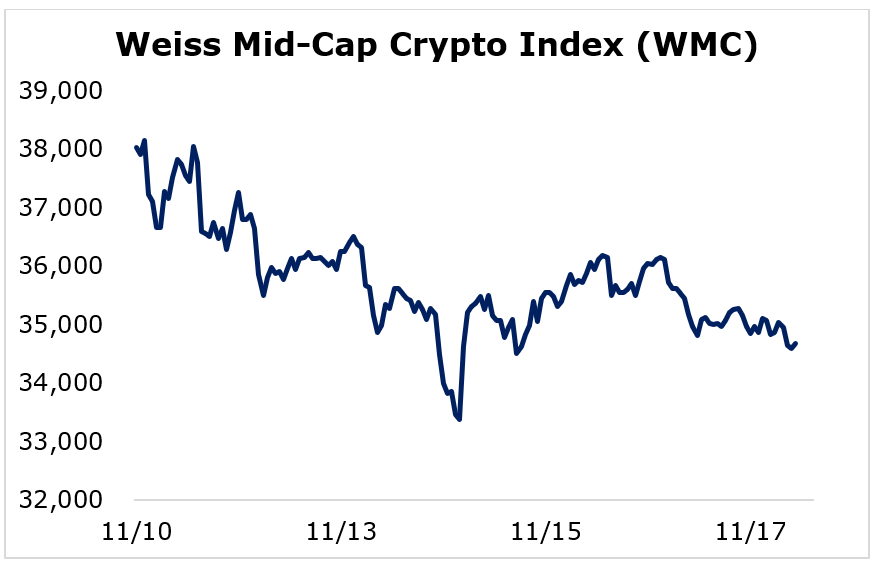

Mid-cap cryptos lost the least, but the Weiss Mid-Cap Crypto Index (WMC) still decreased 8.84%.

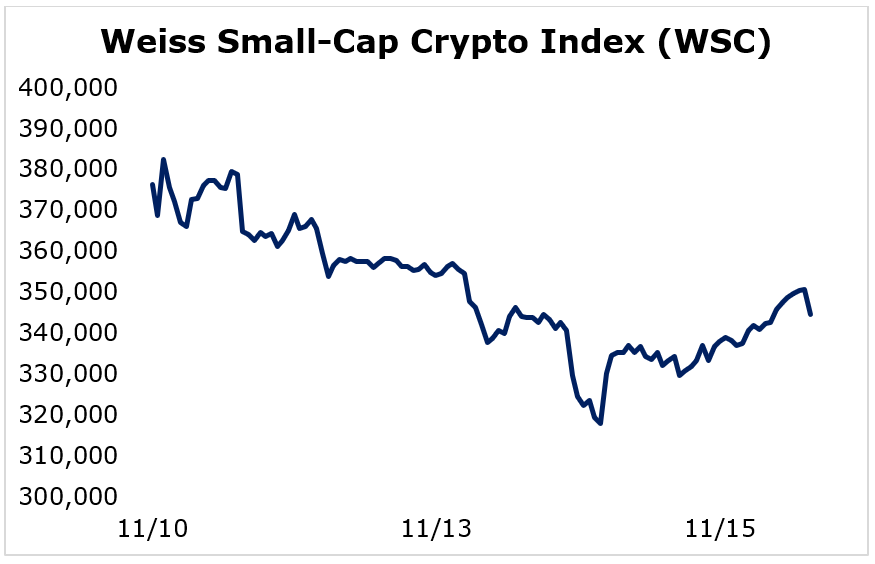

The small-caps narrowly underperformed, as the Weiss Small-Cap Crypto Index (WSC) fell 10.76%.

The crypto market had a rough couple of weeks, but it's a positive sign that prices appear to be stabilizing. If the largest cryptos manage to hold themselves above key support levels, the broader market could establish a bear market bottom soon.

Notable News, Notes and Tweets

- Crypto exchange FTX's collapse could leave over 1 million creditors seeking their lost deposits, according to a filing for its bankruptcy case.

- A newly introduced bill could integrate crypto into Russia's economy by legalizing mining and the sale of mined assets.

- El Salvador President Nayib Bukele announced that the country will buy one Bitcoin per day. This plan went into effect on Nov. 17. El Salvador current owns 2,381 BTC at a cost of $103 million, but its investment has fallen to $39.4 million during current market conditions.

What's Next

Although the market appeared to be approaching the end of crypto winter, the recent FTX debacle has added an extra layer of uncertainty to the crypto landscape.

Crypto companies will likely face contagion effects, but the extent is currently unknown as the situation plays out.

The FTX fallout will likely result in a call for regulations, and such regulations may be necessary for mainstream adoption as it will help quell the worries of institutions. After this fiasco, institutions may be more cautious when entering the crypto space, but the next bull market should cast away most doubts.

On a positive note, macroeconomic headwinds seem to be slowing down. Two positive inflation reports showed consumer and wholesale prices accelerated less than expected. If this trend continues, a Federal Reserve pivot could be on the horizon.

The market is already becoming more optimistic about a rate hike slowdown. And if the Fed dials back on its economic tightening, crypto will have a better environment to recover.

Best,

Sam