|

| By Sam Blumenfeld |

Bitcoin (BTC, Tech/Adoption Grade "A-") and other cryptos are slipping as the market loses the momentum it gained during the relief rally from June's lows. As prices pull back, most cryptocurrencies are in danger of breaking below their uptrends.

BTC managed to break the $25,000 level twice this week, but both instances prompted quick selling. Now, the market leader is trading 8% lower so far today, hovering around $21,400. It's currently sitting 11% below where it was last week and 9% below a month ago.

Bitcoin is likely going to log six consecutive red candles, which doesn't bode well for the broader market. The asset fell below its 21-day moving average of around $23,500 on Wednesday, and it continued tumbling lower after losing its short-term momentum.

Given the current bear market state of the cycle, it's unlikely we'll see more upside. Positive macroeconomic data and greater expectations of a Fed policy pivot would certainly help prices, but we'd likely see an uphill battle even if a pivot came soon.

Here's Bitcoin's price in U.S. dollars via Coinbase (COIN):

Ethereum (ETH, Tech/Adoption Grade "A-") is also down 8% today as the asset tries to maintain its positive trend. It currently trades near $1,700, but it will need to find support quickly to sustain its recent streak of establishing higher lows and higher highs.

Ethereum has outperformed Bitcoin recently, logging a 10% monthly gain compared to the latter's 9% loss, and ETH had managed to stay above its 21-day moving average longer, only slipping below in today's downward move.

It's important for Ethereum to find solid support investors look forward to the Merge and the network's shift to proof-of-stake consensus. Any weakness in the interim would likely be felt by the broader market because ETH has led prices higher as optimism builds.

Here's Ethereum's price in U.S. dollars via Coinbase:

Index Roundup

Before today's broader slide, the crypto market ended the seven-day trading week flat despite heightened mid-week volatility. Performance varied slightly throughout the market, with less established cryptocurrencies managing to finish stronger.

The Weiss 50 Crypto Index (W50) dipped 2.12%, but the move was less significant than today's market-wide drop lower.

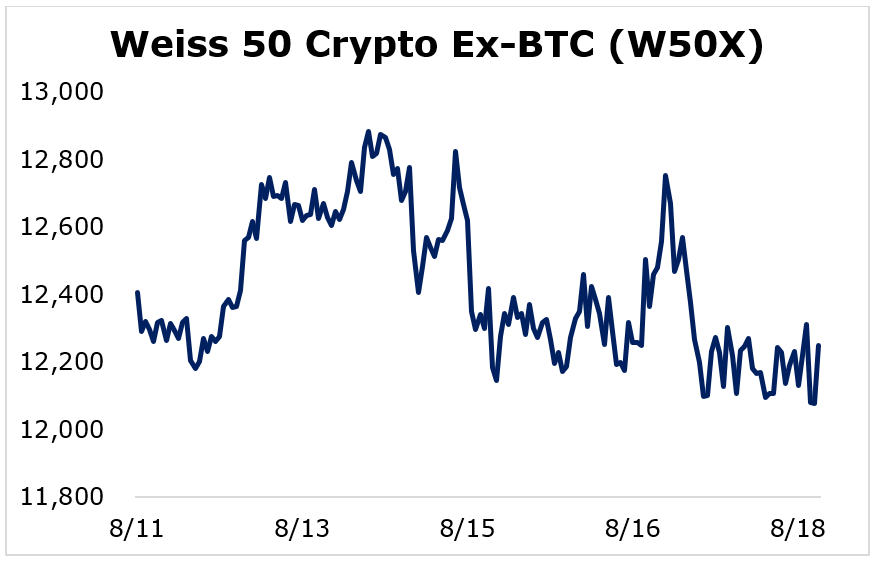

The Weiss 50 Crypto Ex-BTC Index (W50X) slid 1.26%, as altcoins held their value marginally better than the market leader.

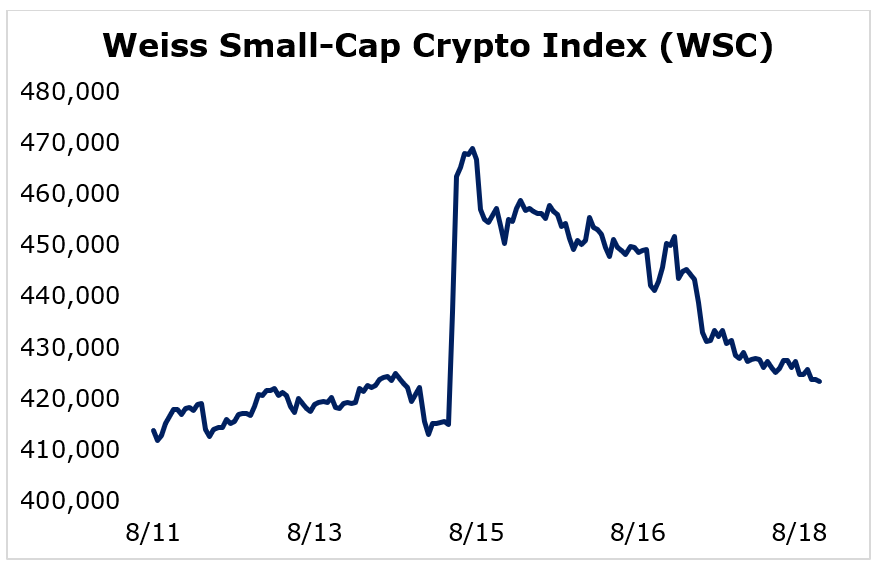

Breaking down performance this week by market capitalization, we see that the small-caps were able to edge higher despite weakness among the more established cryptocurrencies.

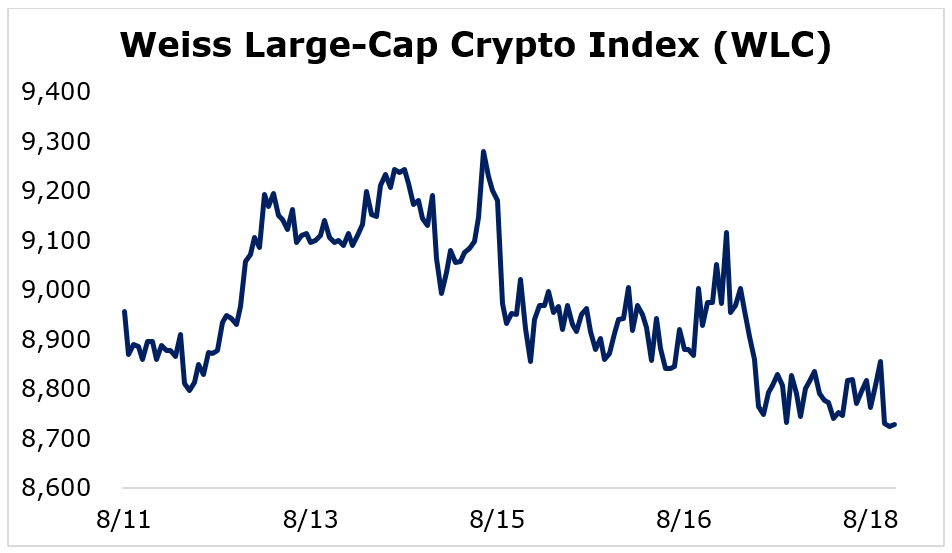

The large-caps finished slightly lower this week, as the Weiss Large-Cap Crypto Index (WLC) decreased 2.55%.

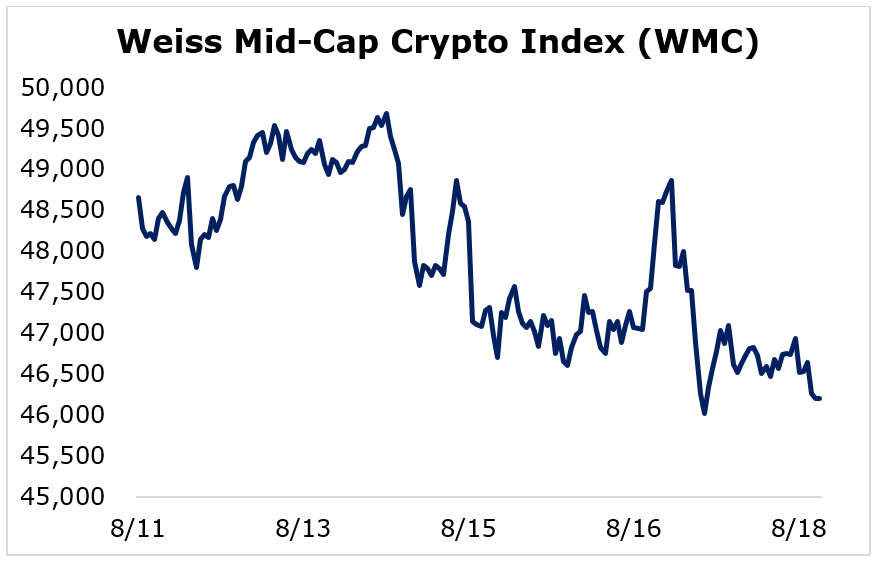

The mid-caps were the biggest underperformers, with the Weiss Mid-Cap Crypto Index' (WMC) declining 5.06%

The small-caps were the only winners, as the Weiss Small-Cap Crypto Index (WSC) rose 2.33%.

It'll be important to see if the crypto market finds support soon, because if not, it could spell the end of the relief rally.

Notable News, Notes and Tweets

- Pomp questions Turkey's commitment to low interest rates despite the country's soaring inflation.

- Ethereum co-founder Vitalik Buterin praises the ETH community for fighting against crypto purchase limits in Canada.

- A series of liquidations has contributed to crypto's downward move today.

What's Next

Both crypto and traditional equity prices have rebounded over the past couple of months. in anticipation of a Federal Reserve policy pivot, but that's far from guaranteed. The number one priority for the Fed is taming inflation, which will likely hurt prices of risk assets if tightening continues.

For now, a lot will depend on the market's expectations of future Fed policy. The Fed's July meeting minutes were released on Wednesday, and they showed the central bank's commitment to raising rates until inflation decreases significantly.

With a strong labor market, the U.S. central bank can continue aggressively tightening.

It will be difficult for the crypto market to establish a sustainable uptrend under tighter economic conditions. Coupled with the current bear market, investors will likely have to wait out additional price weakness before the next uptrend.

However, once conditions are more favorable, surging adoption should push crypto to new heights.

Best,

Sam