|

| By Martin Weiss |

The Fed says it's getting tough on banking and financial markets.

But everyone who understands the real world knows that's a joke. And it's not funny.

Consider the facts:

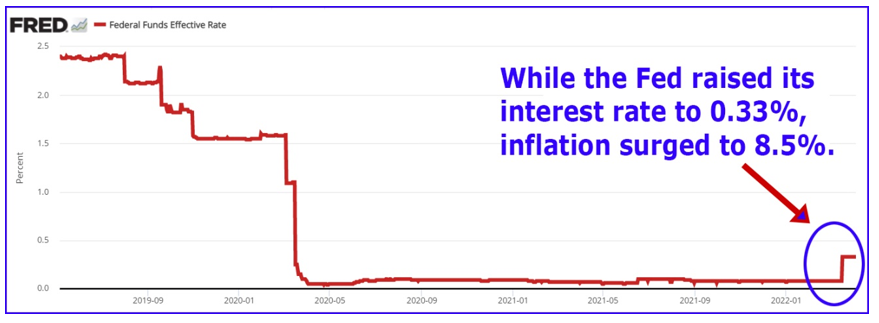

For the Fed, "tough" means raising its key interest rates …

From an absurdly low 0.08% (less than one-tenth of a percent) …

To a meager 0.33%, where it still sits today:

Meanwhile, the inflation rate surged from less than 2% to 7.9% … to 8.5%.

So, after subtracting inflation (the only rational way to view interest rates), what does this REALLY mean?

It means the Fed's rates didn't go up. They went down.

That's right.

Before the Fed rate hike, the inflation-adjusted interest rate was 7.82% below zero.

Now it's even lower, at 8.17% below zero.

The Fed was deep in the hole before. Now, it's deeper into the hole.

Will it find a way to crawl out? Fat chance!

Even if inflation goes no higher. And even if the Fed makes good on all its threats, what happens?

Its key interest rate will still be under 2%.

The inflation will still be over 8%.

And after inflation, the real interest rate will still be at least SIX full percentage points BELOW ZERO.

Consider this scenario (after all the Fed rate hikes):

- Your bank takes your $100,000 deposit, still paying you less than 2%.

- You get $2,000 in interest.

- But when it comes time to paying you back, your money is worth $8,000 less.

- You lose $6,000. And one way or another, your loss is the bank's gain.

That's the Fed getting tough on the banks?!

Give me a break!

Or just look at the history:

The last time inflation had surged, back in the late 1970s and early 1980s, the Fed raised its interest rates to nearly 20% (about 200x times higher than this past March).

This time, Fed policy has been very different indeed.

Instead of raising rates with inflation, the Fed has kept its rates near zero percent for the longest period in U.S. history.

Heck, even during World War II and its aftermath, a time when the government needed every penny to crank up its massive war machine, the Fed didn't hold rates down nearly this low or for nearly as much time.

How do they do it today?

I'm sure you know the answer.

They've been running the money printing presses like never before.

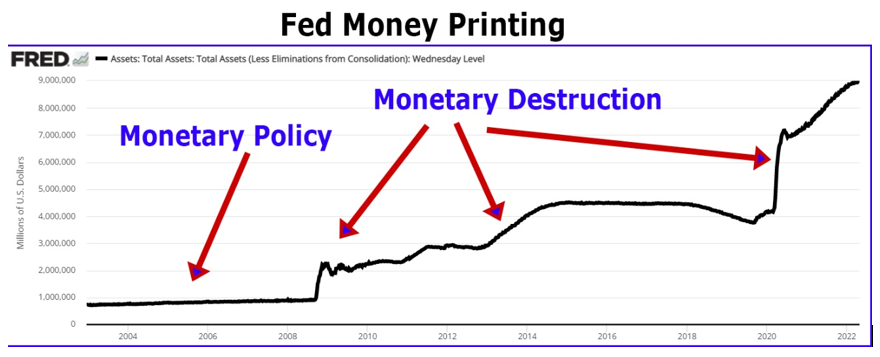

Take a look …

Until 2008, they did it at a relatively slow, steady pace.

No sudden money-printing splurges. No buying up the junk assets of nearly every major bank in the country. Just textbook monetary policy.

Then, starting on Sept. 15, 2008, when Lehman Brothers failed — that's when the Fed first went wild.

And it's been on the same wild escapade almost every year since.

I don't call that monetary policy.

I call it monetary DESTRUCTION.

And the ultimate consequences for investors could be far-reaching:

The destruction of your money, including the supposedly "strong" U.S. dollar.

The weaponization of the currency — governments using it to achieve political and geopolitical goals.

An inevitable decline in the global economy — sometimes gradual, sometimes chaotic.

The end of the traditional financial system as we know it.

The rise of alternative forms of money.

The emergence of an entirely new, mostly decentralized financial system.

Plus, much more.

To learn one great way to fight back, attend our online training sessions, starting Tuesday, May 10.

Click here for free registration, and I'll send you all the details.

Good luck and God bless!

Martin